Canada Life’s My Par Gift

Benefaction accepts gifts of life insurance from our donors and issues tax receipts accordingly. Donors have the option to: (1) transfer ownership of an existing life insurance policy to Benefaction, (2) purchase a new policy and name Benefaction as owner and beneficiary, (3) make a bequest of life insurance proceeds to pass to a Benefaction through their Will, or (4) name Benefaction as the beneficiary of an existing policy.

We are excited about a new insurance product, My Par Gift, launched by Canada Life that can make the benefits of insurance policy donations even easier. With My Par Gift, donors pay a one-time insurance premium, eligible for a donation tax receipt from charities like Benefaction. The charity then owns the life insurance policy and can receive the tax-free death benefit upon the donors passing. Many current life insurance products require ongoing commitment from the donor to cover premiums, whereas My Par Gift requires only a one-time donation. This product is designed to help donors give more than the initial charitable donation made during their lifetime. The donation can grow over time, depending on the market, and has a certain guaranteed growth, deemed by the criteria of the policy.

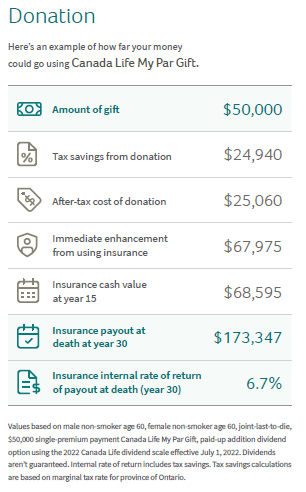

By naming the charity as the owner of the policy, donors are providing the charity with access to a larger payout upon their passing. Additionally, corporations, with an insured controlling shareholder, can become donors for a My Par Gift policy. Below is an example, from Canada Life, of how a My Par Gift donation can create a much larger donation for charities than the initial gift amount. This example is based on a joint-last-to-die insurance policy for a male and female non-smoker, age 60.

My Par Gift is limited to one charity being named as the owner of the policy. However, choosing Benefaction as the charity that owns your My Par Gift policy would allow you to establish a Fund which could then direct grants to multiple charities on your behalf. A combination of My Par Gift with a Benefaction Fund can help you give more from the single charitable donation made during your lifetime, and give to a variety of charities you care most about!

To learn more about My Par Gift, visit Canada Life or speak to your advisor: https://www.canadalife.com/insurance/life-insurance/permanent-life-insurance/participating-whole-life-insurance/my-par-gift.html.

To learn more about how a Benefaction donor advised fund works, visit the Resources page of our website.